Richard Elias's Video eNewsletter Sign Up

Sign up to Get FREE San Diego

Real Estate Video Updates 2x's a Month

Enter Your Email Address to Get Instant Updates...No Spam. Ever

Immigration Reform's Impact on Housing

Immigration reform is a political hot potato to many. We do not want to take a political stance on the issue. We will leave that to others. However, we do want to report on a recent study released by the Immigration Task Force of the Bipartisan Policy Center (BPC) that spoke to the impact reform would have on the housing market.

The BPC did not claim their study was all encompassing and included the following caveat:

“It is important to note that this analysis is not an endorsement of the Senate bill or any other policy proposal. The study does not examine other aspects of immigration reform including demographic or national security concerns, nor does it look at the cultural benefits that immigrants bring to our communities. Clearly, these issues are important considerations for immigration reform proposals.”

That being said, let’s look at what the study did reveal:

Continue to Drive the Housing Recovery

The study commented strongly on the economic impact reform would bring to housing:“Immigration reform would dramatically increase demand for housing units. This would increase residential construction spending by an average of $68 billion per year over the 20-year period.”

The study looked at the effect different policies would have on housing.

Impact of Attrition through Enforcement

“Under the “attrition through enforcement” scenario, residential construction spending declined by more than $100 billion per year compared with the baseline, and by more than $175 billion per year compared with the reference case. This is because the removal of all present and future unauthorized immigrants caused a significant decline in the U.S. population. The departure of current unauthorized immigrants would leave many dwellings vacant and the reduction in future population growth would reduce the need to build additional housing units.”Impact of Immigration Reform

“The analysis examined immigration reform’s impact on the housing market...Demand for housing units increases as new immigrants enter the economy and form households, accelerating the current housing recovery and fueling growth in this sector of the economy. Under the reference case, average spending on residential construction increased by about $68 billion per year, with a peak of more than $110 billion per year in FY2022–FY2025. The first decade’s annual average was about $56 billion per year higher, and the second decade’s was about $81 billion.”The economic impact on housing should not be the only consideration as to whether immigration reform makes sense. But, it is interesting to see the potential outcomes of different policy decisions.

The #1 Reason You Should Sell Now

keepingcurrentmatters.com · by The KCM Crew · January 13, 2014

Home For Sale Sign in Front of New House

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory available in most markets currently, a seller will be in a great position to negotiate.

What Can You Expect to See in the San Diego Real Estate Market in 2014?

What Can You Expect to See in the San Diego Real Estate Market in 2014?

Welcome to 2014! People have been frequently asking me about what the San Diego real estate market will do in 2014 and what direction we are heading in. Obviously we know we experienced some big appreciation in 2013 and some parts of San Diego even show 20% increases! However, I don’t think we will see any appreciation like that in 2014. I say this based on trends, what the economists are seeing and what the real estate gods are saying.

Right now, San Diego has 5,766 active listings with 4,184 being detached single family homes and 1,583 accounting for apartments and townhomes. The housing recovery hit high gear in 2013 with solid homes sales and bigger than expected gains. A lot of this was due to very low demand, very low supply and very low interest rates. When you combine all that, it creates a lot of sales and high appreciation.

Economist John Burns has estimated that we see 6% appreciation nationwide in real estate. However, it would be fair to say that you can’t compare San Diego to the rest of the country. Conservatively speaking, we can expect San Diego to achieve 8-12% in 2014 depending on your area.

According to Fannie Mae, the GSE found that less than half of the people polled expect home prices to increase this year in line with trends pointing to a more measured and sustainable recovery the real estate market. This is great news for people who still want to sell their homes and for those who still want to buy, because the market is going up!

One of the reasons we believe that 2014 will follow 2013 trends is due to three major buyers we have to pay attention to. Number one is the first-time buyers. This is due to a report released by the Urban Land Institute saying that over 4 million new households will be formed over the next three years with millennials making up most of them. Number two is the move-up buyers. Because of the return of real estate wealth and appreciation, Zillow reports that $1.9 trillion in equity has been restored to people who’ve had negative equity. This allows people to sell their homes and move up or down. Number three is due to the Immigration Reform Act. If this is passed, it will be bring a tidal wave of buyers into the market.

Thank you for watching! Please give me a call at (619) 562-6800 if there is anything I can do. Make it a great day!

Predictions for 2014: Interest Rates Will lncrease Significantly

|

Posted: 08 Jan 2014 04:00 AM PST

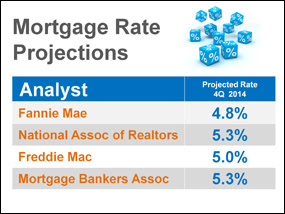

Most experts are calling for an increase in mortgage interest rates in 2014. However, we believe the increase will be more dramatic than is being projected. We believe rates will be closer to 6% than 5% by year’s end.

The Fed announced last month that they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of thislikelihood over the last several months.

Above are the most recent projections of where rates will be at the end of 2014 by the four major agencies. However, we believe that the government is not afraid to shoot right past these levels.

Doug Duncan, chief economist for Fannie Mae, this past summerannounced:

“I don’t think the Fed ultimately would be troubled with a 6.5% mortgage rate.”

And Frank Nothaft, Freddie Mac VP and chief economist, at virtually the same time explained:

"As the economy continues to improve, we expect to see continued upward movement in long-term interest rates… At today’s house prices and income levels, mortgage rates would have to be nearly 7 percentbefore the U.S. median priced home would be unaffordable to a family making the median income in most parts of the country.”

Only time will tell. However, we feel that rates will be in the 5.75-6% range by year’s end.

|

Subscribe to:

Posts (Atom)